By Priscilla Alabi

About four months after he was dismissed for exposing alleged corruption, an auditor of the Federal Mortgage Bank of Nigeria, FMBN, Murtala Ibrahim, remains determined to ensure justice and accountability in the firm.

“I would like for my appointment and that of my colleagues to be reinstated,” said Mr. Ibrahim whose appointment with FMBN was terminated by the Group Head of Human Resources, HR, on May 8; a move he says the bank’s management had no legal rights to perform.

In a letter to the Managing Director and Chief Executive of the bank soon after his appointment was terminated, Mr. Ibrahim stated that “the law that established the Bank (FMBN Act 2003) is explicit on where the powers of appointment and dismissal (other conditions of service) of staff resides,” therefore FMBN management had “no such powers to dismiss the Board’s appointment without recourse to the Board/Minister.”

Mr. Ibrahim, who had been at the FMBN since 2010 provided meticulously detailed official documents of his interactions with what he says were corrupt actions of management at FMBN when he was Unit Head of the Internal Audit Group, IAG.

Mr. Ibrahim’s unfortunate episode with the FMBN began in August 2016 when the bank created a parallel auditing group that duplicated the functions of the office he and his colleagues already performed. According to documents Mr. Ibrahim released, the management said the new group was intended to oversee the internal affairs of the bank.

“We knew the financial regulations like the bible,”Mr. Ibrahim said of his office at the Internal Audit Group, IAG, at FMBN. “We are the encyclopaedia of due process, so when management created the [Internal Control and Compliance) group, we knew they were up to something nefarious.”

AN ESCALATION OF CRISIS

An August 19, 2016 memo from IAG to FMBN management shows that the issue escalated when the former managing director of the bank, Richard Esin, “pressured” the IAG team to release a monthly sum of roughly N180 million to the Social Service Group, SSG, to continue to supervise the renovation of the Mamman Kontagora House, MKH, the bank’s building in Marina, Lagos.

The IAG refused to provide the payments, saying “due process was not followed at the inception of some of these contracts” to complete the renovation; and that there was “contract splitting”.

Furthermore, upon the IAG’s review of three of six valuation reports, “it was discovered that the value of work done (on the MKH building) was not commensurate with the amount of monies disbursed”.

Soon after that, the former Managing Director, Richard Esin, requested that the IAG should agree to “transfer the statutory functions” of the group to the newly created Internal Control & Compliance Group, IC&G.

Mr. Ibrahim and his team, then headed by Anibaba Taslim, responded with memos highlighting the problematic nature of the request, stating that transferring the IAG’s statutory functions “was a breach of laws of the federation (Financial Regulation 2009) which [they] couldn’t be party to”.

The team also shared their professional opinion that the request and forced approval of an increase in the amount of the contract for the MKH building in Lagos is illegal by both the bank’s standards and EFCC standards.

Additionally, in a memo from Internal Audit to the Ag. MD/CE on August 25, 2016, Mr. Ibrahim and his colleagues said they were particularly concerned that the funding to renovate the MKH building were being taken from the National Housing Fund, NHF.

The August 25 memo stated that “management ought to have analysed the funding options as projects are not expected to be financed from NHF funds,” because “FMBN was undercapitalised with negative equity arising from the burden of Non-Performing Loans”.

However, the bank reported a half-year surplus of over N400 million (N423,653,187), which the IAG suggested was “grossly misstated.” Therefore, the group suggested to management in another memo on October 14, 2016, to direct the finance and accounting group to rework the bank’s accounts accordingly. They also suggested the management team should suspend interests on non-performing loans “in order to reflect the true and fair view of state of affairs of the Bank.”

AN ANGRY MANAGEMENT

Evidently, FMBN’s management was unhappy with these suggestions because Mr. Ibrahim received a query from the group head of Human Resources, HR, shortly after that memo was sent. In the query, HR claimed that Mr. Ibrahim used foul and abusive language, and showed “insubordination, insolence and rudeness” in the IAG’s memos to management.

The query was sent to Mr. Ibrahim’s home on December 22, 2016 and he was given 48 business hours to respond.

Meanwhile, Mr. Ibrahim had been granted a six-week leave of absence which started on November 28, 2016 from the very same HR that sent a query to his house on December 22. He said HR was aware that he was not at home in Abuja, and that he was in Malaysia where he was completing coursework for a self-funded Ph. D program.

Mr. Ibrahim believes that the query was to his home to “destroy the remaining peace [and] tranquillity in [his] family by taking the battle right into the doorstep of [his] harem after successfully transferring [him] to the farthest Taraba State Office for no offense,” he said in a January 9, 2017 letter to the Minister of Power, Works and Housing, Babatunde Fashola.

Mr. Ibrahim said his decision to write a letter to Mr. Fashola, and copy the Inspector General of Police, regarding the dangers the possible breach of financial regulations, was due to the lack of safety he perceived after the first query was sent to his home to “intimidate my family.”

Erstwhile, Mr. Ibrahim had received a memo on December 7, 2016, during his leave, that he had been transferred out of the head office in Abuja and was to resume duty in Taraba State when he returned in January. When “ordinarily, they ought not to have any official communications with me until after my resumption,” he said.

Mr. Ibrahim concluded that the transfer of himself and his colleagues (Mr. Anibaba, the Group Head of the IAG was also transferred) was a punishment for “not playing along.” He said the transfers also left the door open for the newly created Internal Control and Compliance Group, with far fewer qualifications than the IAG team to take over the statutory functions of the IAG and “carry out their evil deeds like they planned all along.”

Mr. Ibrahim received a second query on February 1, 2017 because of his letter to the Minister of Works and Housing, Mr. Fashola. In it, HR claimed that Mr. Ibrahim’s allegation that he was transferred to Taraba because of nefarious reasons were false, and that 281 staff were transferred bank-wide. The query also stated that he violated the Oath of Secrecy which he swore to uphold when he shared FMBN memos and documents with parties outside of the establishment.

In his response to the query, Mr. Ibrahim explained that he would not have had “problems with the transfer provided they are carried out with sincere intentions and interest of the FMBN.” But the decision to transfer almost everyone in the IAG group at the same time was unprofessional and not in the best interest of the bank, he said.

In the same response to the February 1, 2017 query, Mr. Ibrahim noted that the bank “wrongly”credited four different amounts totalling N856,220 to his account, while he was on leave between November 2016 and January 2017. He said this further signified mismanagement of the bank’s funds, which was his concern all along.

A few days later on February 6, 2017, Mr. Ibrahim received a third query which indicated that there were sums totalling N565,220 credited to his account for trainings he did not attend in November and December. Consequently, he was found guilty of breaching “professional ethics, rules and regulations of the bank.”

In his response to the 6 February query, Mr. Ibrahim noted that, again, he was on leave at the time of the training. Furthermore, he returned the entire sum of money credited to him ‘by mistake’ as well as for the training, to the bank when he returned to Nigeria from Malaysia a month later.

FMBN REACTS

After multiple attempts to get information from the FMBN on the reasons for its actions, PREMIUM TIMES was able to speak with high ranking officials at the organisation who wished to be unidentified.

Even though the officials had received a formal letter from PREMIUM TIMES on its enquiry, they agreed to speak only on the condition that their names would not be mentioned.

They said Mr. Ibrahim had already predetermined that he would not get justice, and did not exhaust the system first before he broke his Oath of Secrecy and shared documents with the Minister of Power, Works, and Housing.

The FMBN officials also said the Mr. Ibrahim’s appointment was terminated for three reasons: the first is for fraud (because they credited money for trainings he could not attend – while he was on official leave of absence); the second, because he broke his oath of secrecy; and finally, because his memos “disrespected hierarchy by using foul and abusive language which denigrated the establishment.”

The FMBN officials also alleged that Mr. Ibrahim did not share those three reasons with the public because he had something to hide. However, Mr. Ibrahim did in fact make all the documents, including his letter of termination which states why he was terminated, available to PREMIUM TIMES.

Mr. Ibrahim still holds that his termination is “without any legal backing.”

He believes his ordeal with the FMBN may be “a test from the almighty.” For him, his fight belongs to all Nigerian citizens with personal interests in the Federal Mortgage Bank of Nigeria.

In a Facebook video posted July 20, 2017, Mr. Ibrahim communicated that many Nigerian workers have contributed 2.5 per cent of their basic salary to the NHF, which the FMBN manages. Therefore, his fight belongs to all Nigerian citizens with personal interests in the Federal Mortgage Bank of Nigeria, he said.

For him, the issue also extends far beyond his rightful reinstatement. He said the issue is really about investigating all allegations of corruption, and holding everyone involved in those cases to account.

“It’s not the angels that will come from the heavens and change the country for us,” Mr. Ibrahim said, “we have to sit up and make things work for ourselves.”

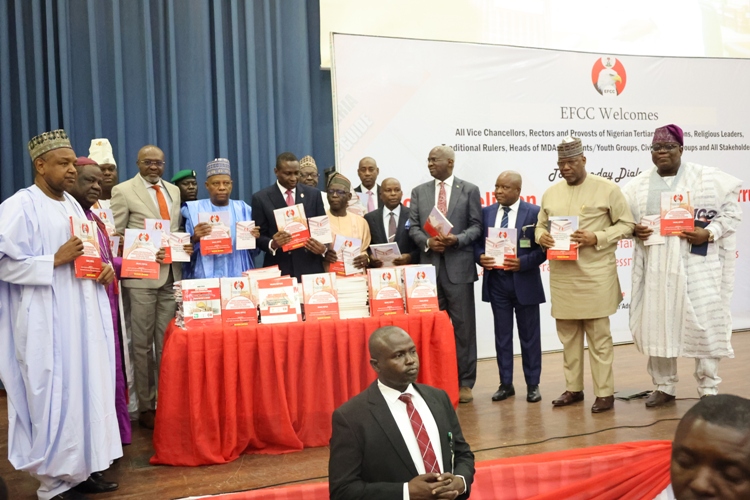

CIVIC GROUPS REACT

For civil society organisations who have monitored Mr. Ibrahim’s case, his situation is a major test of government’s commitment to the fight against corruption.

“We believe that his case is major challenge to the government to convince Nigerians that whistle-blowers who expose corruption will be protected,” Lanre Suraj, the head of the Civil Society Network Against Corruption, CSNAC, said.

For Chido Onumah, head of the African Centre for Media and Information Literacy, AFRICMIL, the government needs to show more concern in Mr. Ibrahim’s case

“If the government wants to be taken seriously in its anti-corruption war, how it handles cases like Mr. Ibrahim’s will be a major factor,” he said.

Mr. Onumah said his organisation was aware that Mr. Fashola, whose ministry supervises the FMBN, had set up a committee to look into Mr. Ibrahim’s case; but it was concerned the whistleblower remains “out of work without salaries” while the review was being done.

How such a man is treated by the government will either encourage or discourage other whistle-blowers in government organisations, he said.

Source: http://www.premiumtimesng.com